27+ Check my borrowing capacity

Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. No credit check is involved nor is it a guarantee of the approved financing which you may.

27 Consumer Debt Statistics 2022 Update

There are 3 things you want to be aware of DSR.

. Simply paying your bills as soon as you receive them and staying on top of your credit card will. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. 800 546-5101 option 2 Your Relationship Manager.

Before you look for a property it is always good find out how much can you afford by calculating your borrowing capacity. View your borrowing capacity and estimated home loan repayments. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

For example if you have a 5000 credit card limit and you owe 1000 on that card the math for. Compare home buying options today. Plus 80 of projected rental income.

Your debt-to-income ratio is a metric that your loan officer will. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. Thus as part of calculating your borrowing capacity it is.

Examine the interest rates. About 380000 less After going through the above three tables we hope that you have a better understanding about how. 212 441-6600 Custody and Pledging Services.

Most lending institutions will lend to a maximum ratio of 32 with a 2 loading on loan rates however you should check with your own institution for specific requirements. Estimate how much you can borrow for your home loan using our borrowing power calculator. Multiply your number by 100 to see your credit utilization as a percentage.

Its calculated based on your basic financial information such as your income and current debt. One of the main factors that can affect your borrowing. For a conventional loan your DTI ration cannot exceed 36.

The good news is that you can start to repair your credit and lift your credit score. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

Buying or investing in. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your. Your total gross income salary 50000.

Divide this amount by the interest rate to derive your total borrowing capacity. This calculator helps you work out how much you can afford to borrow. Standard borrowing capacity is between.

BORROWING CAPACITY AT THE FHLBNY FAQS KEY CONTACTS. If youre looking to take out a loan here are four crucial factors that can affect your borrowing power. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt.

27 Consumer Debt Statistics Depicting The Crisis Fortunly

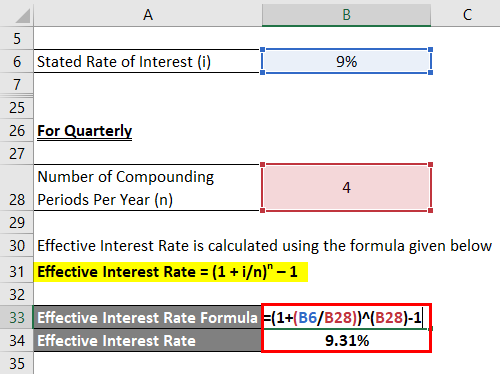

Effective Interest Rate Formula Calculator With Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

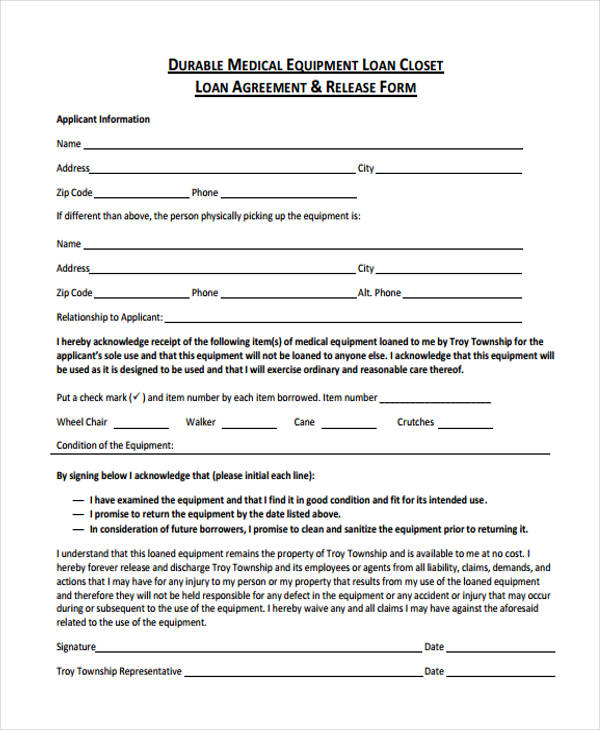

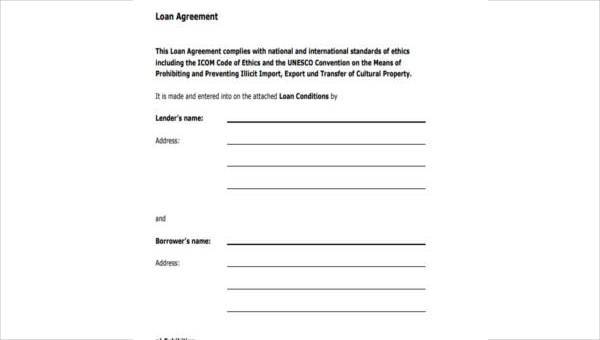

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

27 Consumer Debt Statistics 2022 Update

Adit Edtech Acquisition Corp 2021 Current Report 8 K

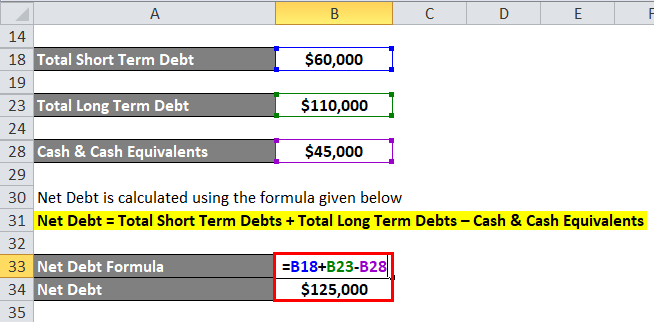

Net Debt Formula Calculator With Excel Template

27 Consumer Debt Statistics 2022 Update

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Effective Interest Rate Formula Calculator With Excel Template

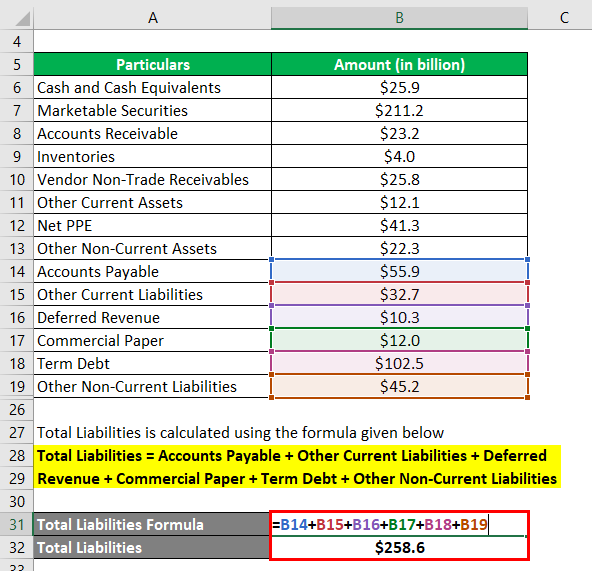

Debt To Income Ratio Formula Calculator Excel Template

Free 34 Loan Agreement Forms In Pdf Ms Word

27 Consumer Debt Statistics 2022 Update

27 Consumer Debt Statistics 2022 Update

Free 9 Sample Loan Agreement Forms In Ms Word Pdf Excel

Net Worth Formula Calculator Examples With Excel Template

Free 9 Sample Personal Loan Agreement Forms In Pdf Ms Word